Microsoft and DuckDuckGo have partnered to provide a lookup Option that provides related commercials to you personally whilst preserving your privateness. In case you click a Microsoft-supplied advertisement, you will be redirected into the advertiser’s landing web page as a result of Microsoft Promotion’s platform.

Assess lenders. Take into account things like how swiftly they disburse funds, the lender’s track record, and no matter whether you favor to apply in individual or on the web.

A small business loan is actually a sort of financing companies can use to achieve particular ambitions. Small businesses trust in loans from banks, credit unions, and on-line lenders to fund day-to-working day business desires, like salaries or stock, and large expansions or purchases, like renovating a warehouse or growing an office Area.

Many or the entire merchandise featured Listed below are from our partners who compensate us. This could influence which goods we create about and the place And just how the merchandise seems with a web site.

In lots of conditions, the devices acts as collateral for the loan. Nonetheless, some lenders may possibly demand businesses to personally promise payment, Placing themselves and their other assets at risk when they fall short to repay.

Invoice factoring, also known as invoice financing, is a way for businesses to leverage their accounts receivable invoices to acquire funding. Numerous businesses market goods and solutions on credit history, meaning shoppers don’t immediately fork out the business, and an invoice is designed exhibiting when and exactly how much The shopper pays.

Disclaimer: NerdWallet strives to maintain its info precise and up-to-date. This info get more info might be distinctive than That which you see once you stop by a economic institution, services provider or distinct solution’s web page. All economic goods, procuring products and services are presented devoid of warranty.

Forbes Advisor adheres to rigorous editorial integrity standards. To the top of our awareness, all material is correct as in the date posted, nevertheless features contained herein could no longer be out there.

SBA 504 loans are an incredible option for funding big facility advancements or machines purchases, Nonetheless they don’t sound right For each and every business proprietor. Here are some solutions to take into account:

You'll find business loans with lessen minimal credit rating requirements, with some skipping credit score checks entirely.

Applications are processed and facilitated because of the borrower’s CDC with forty% of funding coming from that entity and backed from the SBA. The remaining fifty% in the loan total originates from A non-public sector financial institution or credit history union, and borrowers are responsible for a ten% deposit.

Professional Tip: “Businesses require to get ready properly when making use of for business loans. They should have a strong business system and economic projections, and also reveal how the loan will lead to The expansion of the corporation.

CDCs are nonprofit economic advancement businesses that intention to help economic enhancement in the community. A listing of CDCs is accessible on the SBA’s Web page.

An SBA loan has a longer repayment time period than most classic loans but need to be used for certain and accredited applications. Businesses have diverse loan solutions, such as the 7(a) loan for charges like working cash, partner buyouts, and refinancing business real estate.

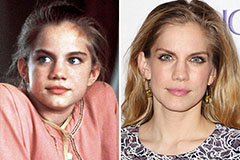

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Kane Then & Now!

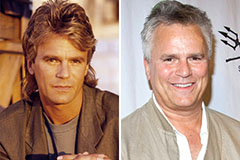

Kane Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!